How to Apply for Capital One Quicksilver Card

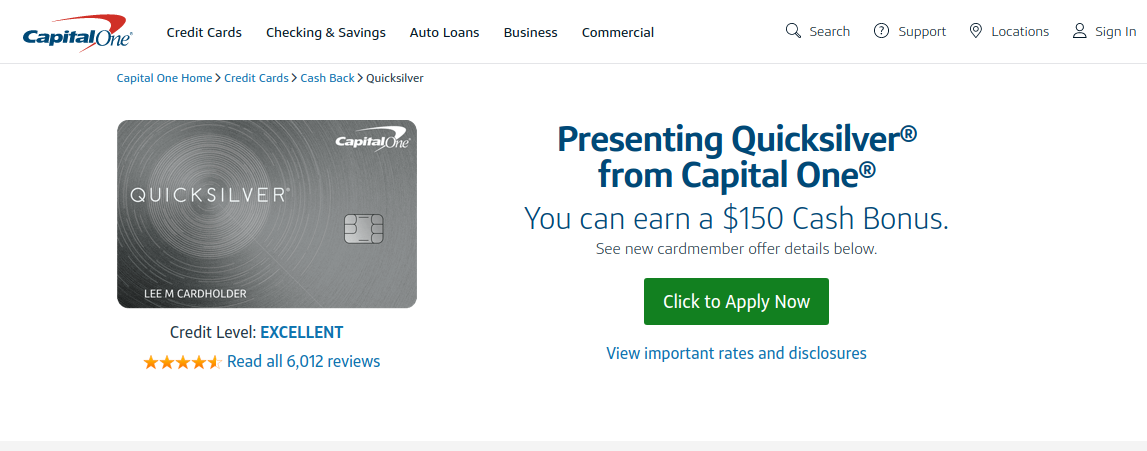

You can Apply for Capital One Quicksilver Card at the web portal of the Capital One Bank. If you are a customer of the bank then you can even get the pre-approved credit card offer. However, anyone who is willing to add the card to the fleet can apply at the website of the bank. The application requires a few minutes. You need to fill out the form at the webpage of the bank and submit for approval.

The credit card is a settler in providing 1.5% cash back on everything you purchase through it. You can redeem the cash anytime you wish without any limits. Here we strive to assist you with making financial decisions. Read the guide below to find how to apply for the Quicksilver Card.

Benefits of the Capital One Quicksilver Card

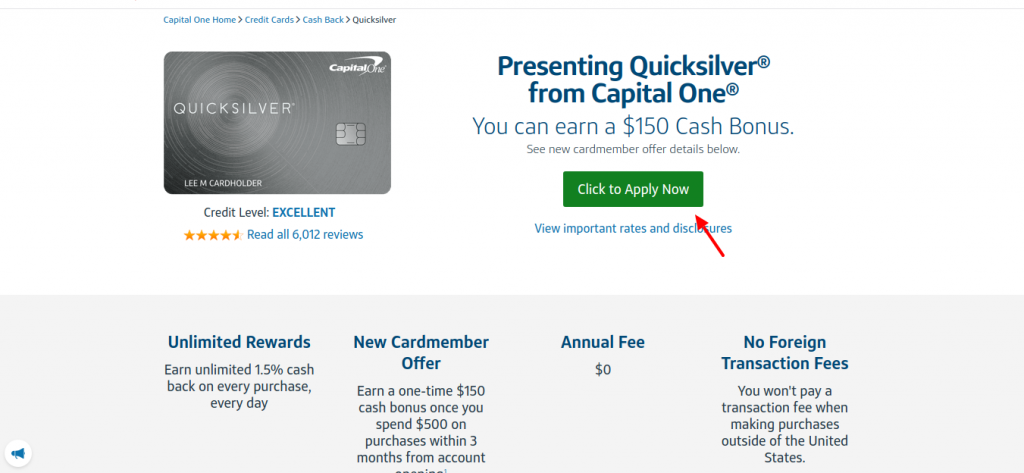

- The Capital One Quicksilver Card has a one-time bonus on making purchases within 3 months of account opening.

- You can get an unlimited 1.5% rewards on everyday purchases.

- The credit card company offers you online account management.

- APR rate would be low if you have excellent credit worthiness.

- New card members get a one-time bonus of $150 on spending $500 within 3 months of account opening.

- Annual fee is $0.

Capital One Quicksilver Credit Card Rate and Fee

- There is a variable APR rate of 16.24%, 22.24% or 26.24%

- Apr for cash advances is 26.24%

- The annual fee is $0

- Cash advance rate is $10 or 3% whichever is greater

- Late payment fee is $38

- 3% is charged for balance transfers

Requirements for Application

- To apply you must have at least a good credit score.

- Have a valid SSN

- Be a resident of any of the 50 U.S. states

- Have internet-connected devices such as a smartphone, tablet or computer?

Capital One Quicksilver Card Application Guide

- The Capital One Quicksilver Card Application can be done through the website of Capital One. www.capitalone.com/credit-cards/quicksilver

- Once the credit card website opens you will find the ‘Apply Now’ button at the center.

- Now the system will direct you to a new website which features the application form.

- Complete the personal information section with the following data:

- First name

- Last name

- Date of birth

- Social security number

- Are you a U.S. Citizen

- Next complete the contact information section:

- Residential address

- Suite/APT

- Email address

- Primary phone number

- Scroll down and there will be the financial information section:

- Employment status

- Total annual income

- Monthly rent/mortgage

- Choose if you have bank accounts

- Complete the additional information section by checking the box below. Choose a language whether English or Spanish.

- Scroll down to view the rates and fee and click ‘Continue’.

- Now you can submit the application form.

How to Check Application Status

If you apply for a Capital One Credit Card online you can get a response within 60 seconds. However, if you are willing to check status or track the progress of your card you can call on 1-800-903-9177.

How to Activate Credit Card

- For activating the Capital One Credit Card you need to go to the activation page. www.capitalone.com/activate

- To activate the card online you need to log into your existing Capital One Credit Card account.

- If you do not have an online account you can register for a credit card account by selecting the ‘Register’ button.

Also Read : How To Apply MY Texas Benefits Online

Conclusion

It is easy to Apply for the Capital One Quicksilver Card. While some might find the task cripple. If you too find the application process difficult then you can find the guide above.

Reference :

www.capitalone.com/credit-cards/quicksilver