The State of Wisconsin is clutching a huge number of dollars worth of unclaimed property and some of it may be yours. The revenue department of Wisconsin has dealt with the unclaimed property settlement of the residents from the year of 2013, they not only done this but they have returned unclaimed properties worth of $119 million from the beginning of the year 2017.

In March alone, the Department of Revenue returned $2 million to unclaimed land owners. In 2015, the state organization started utilizing state charge information to find proprietors of unclaimed property.

The unclaimed property law additionally necessitates that utility stores, unclaimed wages and property coming about because of a business conclusion, be accounted for as unclaimed property following one year of latency. The law does exclude land. Property becomes unclaimed or surrendered when there isn’t proprietor action on the record for a time of one to five years (It will be based on the type of property it is) this is also should be reported to the DOR, only when the benefit holder do not contact the proprietor just because of the left determination from their part.

A holder may incorporate a bank, reserve funds organization, credit association, protections financier firm, common store organization, insurance agency, business or service organization.

Their office controls Wisconsin’s duty framework to give income to support state and nearby taxpayer driven organizations. We endeavor to give citizens clear data about our expense laws, advance deliberate consistence, and guarantee charge assortment reasonableness.

The Wisconsin Department of Revenue:

- Controls the state’s significant duty laws, including the assortment of individual personal duties, deals charges, corporate annual assessments and extract charges

- Helps neighborhood governments in property appraisal and money related administration

- Manages programs that give state budgetary guide to nearby governments

- Assessments state incomes and estimates state financial action

- Details state charge arrangement

- Controls the Wisconsin Lottery, which gives property charge alleviation to mortgage holders

- Controls the Unclaimed Property program for property that gets unclaimed or surrendered after a timeframe

How to claim unclaimed properties in Wisconsin

To claim go to, www.money.wi.gov

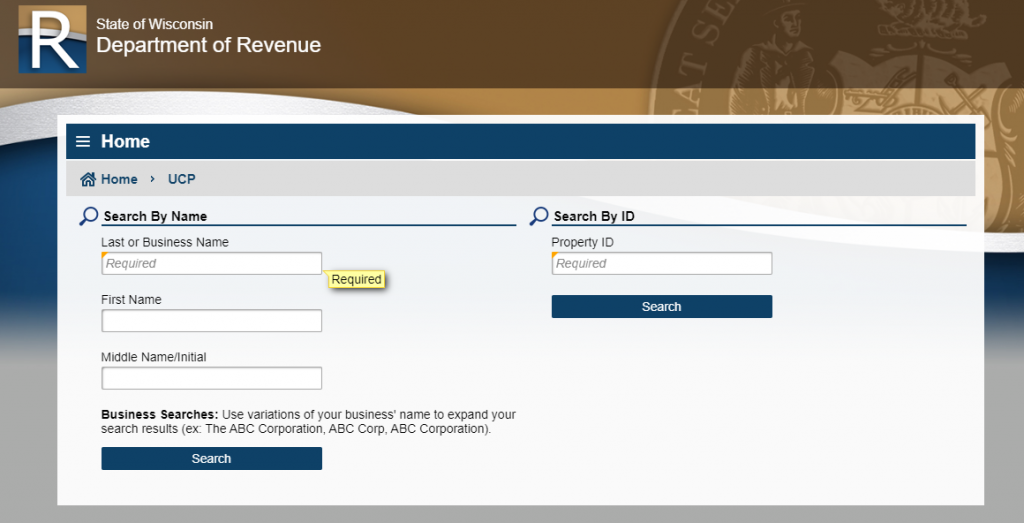

Here, at the middle left part tap on, ‘Search unclaimed property’ you will go to a new tab. Here at the middle provide,

- Last or Business Name of yours

- First Name

- Middle Name/Initial

- Then, tap on the page button, ‘Search’

You can also search by ID. For this enter,

- The property ID

- Then, tap on the page button, ‘Search’

How to check your claim status for Wisconsin unclaimed property

To check it go through, www.money.wi.gov

- Here, at the middle left part tap on, ‘Check your claim status’. You will go to a new tab. Here at the middle provide,

- Confirmation Number

Or

- Claim Number

- Zip Code

- Then, tap on the page button, ‘Next’

How to submit Wisconsin unclaimed property claimed documents

To submit it visit, www.money.wi.gov

Here, at the middle left part tap on, ‘Submit claim documents’. In the new tab enter,

- The claim number

- Or the confirmation number

- Attach the documents

- Then, tap on, ‘Submit’.

To know more about it call on, 608-264-4594. On weekdays, 7:45 am to 4:30 pm.

How to respond to the notice of Wisconsin unclaimed property

To have this visit, www.money.wi.gov

Here, at the middle left part tap on, ‘Respond to notice of unclaimed property’. In the new tab provide,

- Letter ID

- Social Security Number that you have

- Then, tap on, ‘Next’.

How to resume filing a claim for Wisconsin unclaimed property

To resume it visit the site, www.money.wi.gov

Here, at the middle left part tap on, ‘Resume filing a claim’. Here, in the other tab provide,

- Confirmation Code

- Then, tap on, ‘Search’.

Note: For the unclaimed child support payments, you need to visit, www.money.wi.gov. Here, you will get the pdf form and the instructions. The form is available in Spanish and English. For the payment you can call on, (608) 266-9909. Or send it to, PO Box 7935. Madison, WI 53707-7935.

Wisconsin e-document gives four alternatives to paying:

- Direct Debit/Withdrawal: You can document your 2019 return now and pay electronically whenever through April fifteenth. In the event that you record after April fifteenth, you despite everything have the choice to pick direct charge/withdrawal and pay on the day that you document your arrival.

- Pay with Credit Card: You can pay through a Visa. Acknowledged Visas incorporate American Express, MasterCard, Discover, and VISA. You can’t post-date a charge card installment. You will be charged a comfort expense for this alternative. The Department of Revenue doesn’t get any bit of this expense. (Installment made through officialpayments.com)

- Pay with a money order or cash request: You can pay with a money order or cash request. You should finish and print aForm EPV (Electronic Payment Voucher). Ensure the government managed savings number(s), complete name(s) and sum due match the personal assessment form you recorded.

- Pay Online: You can move the sum you owe legitimately from your financial balance, after you have e-recorded your personal expense form.

Read Also.. How to Donate with Goodwill Houston

Customer support

To avail the customer support call on,

- For Individuals: (608) 266‑2486

- Fax: (608) 267‑1030

- For Business: (608) 266‑2776

Also, check out these social media pages,

Reference: