Citi Double Cash Card Application Guide

Do you wish to get the Citi Double Cash Card inside your wallet? If your answer is yes then you can get the card inside your wallet by filling out an application form at the website of the Citi bank. The bank has offered great reward opportunities to the customers through the credit card. The ticket to a low APR rate is excellent credit.

Individuals can get a credit card if they wish to earn double rewards. The impressive rewards rate of 2% makes the card interesting. Furthermore, you get 1% back for using the card anywhere where Visa is accepted. Read the guide below for Citi Double Cash Card Application.

Benefits of the Citi Double Cash Card

- The Double Cash Card from the Citi Bank lets you earn 2% back on eligible purchases.

- Get 1% cash back on using the card elsewhere.

- There is a 0% introductory APR on balance transfers for 18 months.

- The variable APR is based on creditworthiness. If you have an excellent credit the APR would be 15.74%

- It does not charge an annual fee for usage.

- The earned cash backs do not expire.

Citi Double Cash Card Rate and Fee

- APR for balance transfers the amount to 15.74%-25.74%

- APR is 15.74%-25.24

- APR for cash advances is 27.49%

- Due date is 23 days before the close of each billing cycle

- The annual fee is $0

- Cash advance fee amounts to $10 or 5% of the amount whichever is greater

- 3% is charged for making a foreign transaction

- For late payments, the fee is $39

Requirements for Application

- In order to get the card, you need to be a resident of the United States.

- Be at least 18 years of age.

- Have a Social Security Number

How to Apply for Citi Double Cash Card

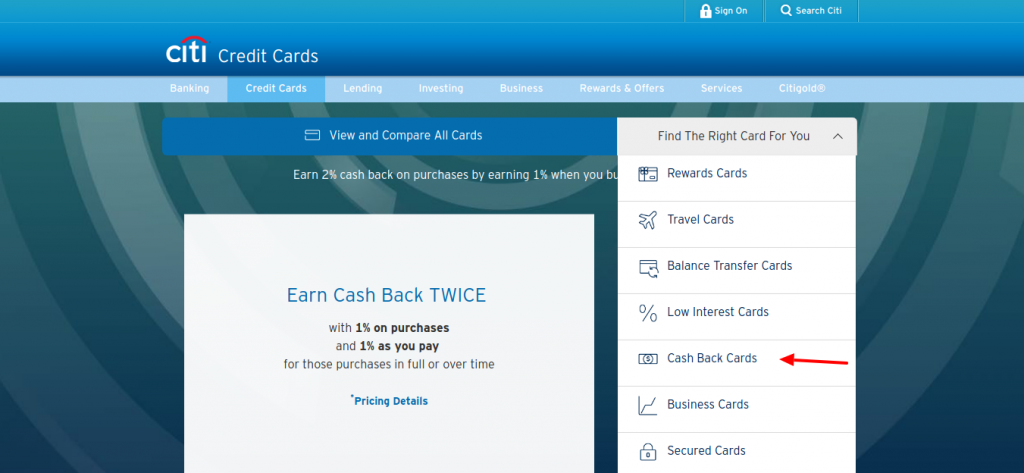

- For applying for the Citi Double Cash Card you need to open the application page of the Citi Bank. Go to www.citi.com/credit-cards click ‘Find The Right Card For You’ then click ‘Cash Back Cards’ or go to the direct link www.citi.com/credit-cards/compare-credit-cards

- Next click on the ‘Learn More and Apply’ button that features at the right of the screen.

- After a while, you will find a section labeled ‘Tell us about yourself’.

- Provide the required data in the personal information to go ahead with the application:

- First name

- Last name

- Date of birth

- Social security number

- Choose if you are a U.S. Citizen

- Type in the address and contact information required:

- Home address

- Zip code

- City

- State

- Primary phone number

- Work phone

- Email address

- Proceed towards the security work part of the application form:

- Security word hint

- Security word

- Fetch the following data in the financial information part:

- Total annual income

- Monthly mortgage/rent payment

- Choose account type

- Now the user is required to check the box below in order to add an authorized user.

- In the next step, you must read the terms and conditions and check the boxes below to agree to the terms and conditions.

- Tap on the ‘Submit’ button to complete the application.

Apply through Phone

Citi Bank also allows you to apply through the phone. In order to apply via phone, call on 1-877-645-3708.

After the call is connected you need to provide the required information and submit an application.

Citi Double Cash Card Check Application Status

- Users who have already applied for the credit card can check their status via the application status check page.

- To begin checking the status, enter the application id and zip code.

How to Activate Citi Double Cash Card Credit Card

- Received the Citi Double Cash Card? Now you need to activate it for making purchases.

- For activating the credit card you must open the activation webpage of the Bank.

- As the webpage opens you will find a section with a heading ‘Activate your Card’.

- Provide the Card Number in the white box and tap on the ‘Continue’ button.

Also Read : How To Activate Walmart MoneyCard Online

Citi Credit Card Customer Service

General Support- 1-800-325-2865

For queries related application- 1-888-201-4523

Conclusion

Anyone who is looking to get the Citi Double Cash Card can apply online or through the phone. The credit card packs a decent amount of rewards and is worthy for anyone who is craving to get rewards. Usage is pretty normal; hence you may compare some other credit cards in this range.

Reference :