Login to Fifth Third Bank Account :

Fifth Third Bank offers customary investment accounts to help clients put to the side crisis assets or put something aside for a major buy. All have a $5 each month administration charge that can be effortlessly postponed by meeting certain prerequisites.

As a significant U.S. bank, Fifth Third Bank offers enough to stand its ground against some other financial organization.

About Fifth Third Bank:

- In excess of 1,100 branches in the Midwest and Southeast, and 50,000 charge-free ATMs cross country

- Advantages for keeping up numerous records

- Numerous low-expense choices for checking and bank accounts.

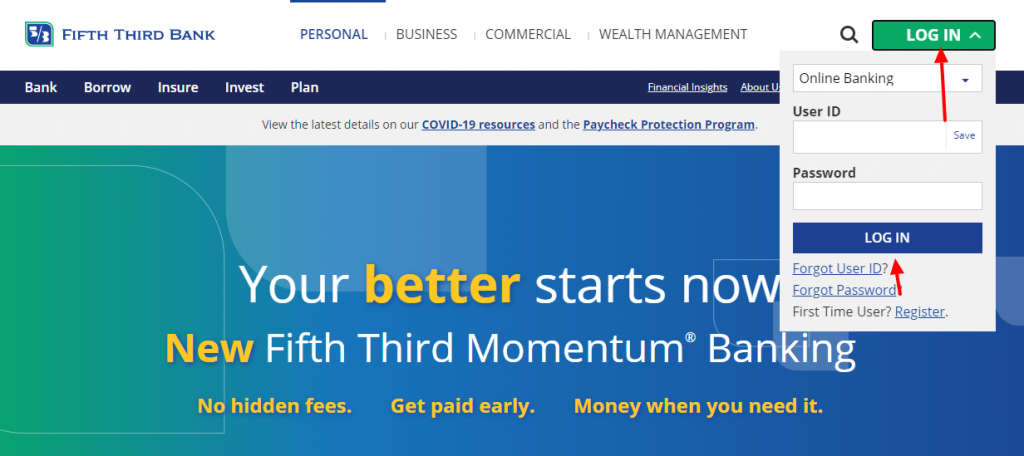

Fifth Third Bank Login:

- To log in open the page www.53.com

- As the page opens at the top right click on the ‘Login’ button.

- In the login dropdown provide user ID, password.

- Now click on ‘Log in’ button.

Retrieve Fifth Third Bank Login Initials:

- To recover the login details open the page www.53.com

- Once the page appears in the login widget click on the ‘Forgot user ID’ button.

- In the next screen provide last name, SSN, zip code, account, or card number hit on the ‘Next button.

- To recover the password enter user ID, SSN, account, or card number click on the ‘Next button.

Register for Fifth Third Bank Account:

- To create the account open the website www.53.com

- As the page appears in the login widget click on the ‘Register’ button.

- You have to proceed with the prompts.

Also Read : Login to your Palmetto Bank Account

Services of Fifth Third Bank:

- Investment Accounts: Fifth Third Bank offers conventional bank accounts to help clients put to the side crisis assets or put something aside for a major buy. All have a $5 each month administration charge that can be effectively deferred by meeting certain requirements.3

- Objective Setter Savings: This essential bank account is intended to deter individuals from pulling out cash. Assets must be gotten to face to face at a branch or by calling 1-800-972-3030. The record offers financing costs of 0.01%. The $5 month-to-month account charge is deferred for the initial 185 days.

- Financial Records: Fifth Third Bank offers seven diverse financial records to address the requirements of different client bases.5 Two are conventional records that work for anybody, while the leftover five serve explicit clients including understudies and military assistance individuals.

- Fundamental Checking: This essential record considers limitless check composing, online bill pays, and auxiliary financial records. The $11 month-to-month administration expense is diminished to $8 each month in the event that you put aside direct installments of $500 or all the more every month.

- Upgraded Checking: Maintain a surplus of $20,000 or set aside $5,000 in direct installments every month to dodge the $20 each month administration expense. Individuals with this record procure a 0.01% premium on their equilibrium, and they are qualified to get higher financing costs on CDs.

- Understudy Banking: This record offers similar administrations as Essential Checking, yet the record charge is postponed for any secondary school or undergrad matured 13 or more seasoned. There aren’t any base equilibrium necessities. Understudies with this record can make five free exchanges each month at non-Fifth Third ATMs.

- Military Checking: This record is like Essential Checking, yet administration individuals can get extraordinary rates on VA home advances and 10 free non-Fifth Third ATM exchanges each month. It’s accessible to various sorts of administration individuals, including deployment ready, veterans, save/watch.

- Express Banking: A fundamental record with no help expense, Express Banking offers a charge card, check getting the money for, direct store, and limits on charges for other Fifth Third administrations. This record doesn’t permit check composing or check stores at ATMs.

- Capable Checking: This record permits people with incapacities to utilize fundamental financial records administrations without losing admittance to government benefits.7 Depending on where you reside and how you utilize the record, you may appreciate uncommon duty benefits.

Fifth Third Bank Customer Service :

To get more information call on the toll-free number 1 (800) 972-3030.

Reference Link: