Checking the Turbo Tax Order Tax Status Online with Turbo Tax Account :

Turbo Tax makes taxing simply by guiding through step by step process and meticulously planning your return even if you haven’t done your tax by yourself previously. With the final review from EA or CPA and unlimited tax advice, stay home and go online with Turbo Tax.

About Turbo Tax :

Turbo Tax is a tax preparation software developed by Michael A. Chapman. It was acquired by Intuit in the year 1993 and its portal is now officially known as Intuit Turbo Tax. As per the agreement with Internal Revenue System (IRS), Turbo Tax now allows its individuals with $66, 00 incomes per year to use Turbo Tax for online tax filing absolutely free. The simple tax returns can be filed for free, thanks to the above-mentioned policy. With 100% accurate calculations and guaranteed maximum refund, you will find no other software like Turbo Tax. The client base of Turbo Tax includes small business owners, freelancers, and independent contractors.

Why opt for Turbo Tax :

Turbo Tax makes taxing easy. All you need to do is mention your income, ownership of any property, number of children, and the amount of any charitable donations made in the year. With 100% accuracy, you can be assured that your tax prices will be successfully executed in compliance with the latest tax laws making you confident that your tax is done right. Here are the features of Tax Turbo:

- Guaranteed Audit Support from IRS.

- Get the option to subtract the Turbo Tax fees from your refund of federal tax while the remaining balance deposits directly to your account.

- Help you choose the right kind of tax from the tax calculator tool as per your income, marital status, property ownership, and more.

- Electronically process your tax ensuring faster refunds.

- Immediate email confirmation from the IRS confirming the status of your tax return.

- On immediate filing, you can also track the status of your tax filing yourself via Turbo Tax mobile app(Android and iOS) as well as an online website and know the exact time when your refund will be credited to your bank account.

- Just click a snap of your W-2. Turbo Tax will verify the data and securely upload all your information to appropriate tax forms for you.

Filing for tax and registering with Turbo Tax account :

While filing the tax, you will be automatically prompted to create an online account. Creating an online account will help you to manage your tax refund securely. And what more, you can come back next year and re-initiate your tax filing automatically from your account with minor changes if applicable. Your data will be saved by default saving much of your time. Here is the process to file the tax step by step:

- Open your browser and visit turbotax.intuit.com.

- Under Sign-In click on Create Account at the right.

- Type in your Email Address.

- Enter the User ID.

- Type in the Phone Number.

- You may choose to verify with text Message. This will keep your account secured.

- Enter the Password.

- Click on Create Account.

- Tell details about yourself by selecting the option that is suitable for you. This will help Turbo Tax to show the best possible recommendations.

- Tap on Show Recommendations after finishing off with options.

- Go through the relevant options and click on the chosen tax.

- Click on Continue to enter your basic and personal information.

- First Name.

- Middle initial.

- Last Name.

- Jr./Sr.(if applicable)

- Date of Birth(mm-dd-yyyy)

- Social Security Number.

- Occupation.

- Specify if you are the meter of the former U.S. Armed Force.

- State of residence.

- Dependent info.

- Physical status.

- Continue with filing.

- The info that is required for the filing are:

- Wages and Income.

- Deduction and Credits.

- Other Tax Situations.

- State Taxes.

- Review.

- Complete with the filing.

Also Read : Login To Your Babylist Online Account

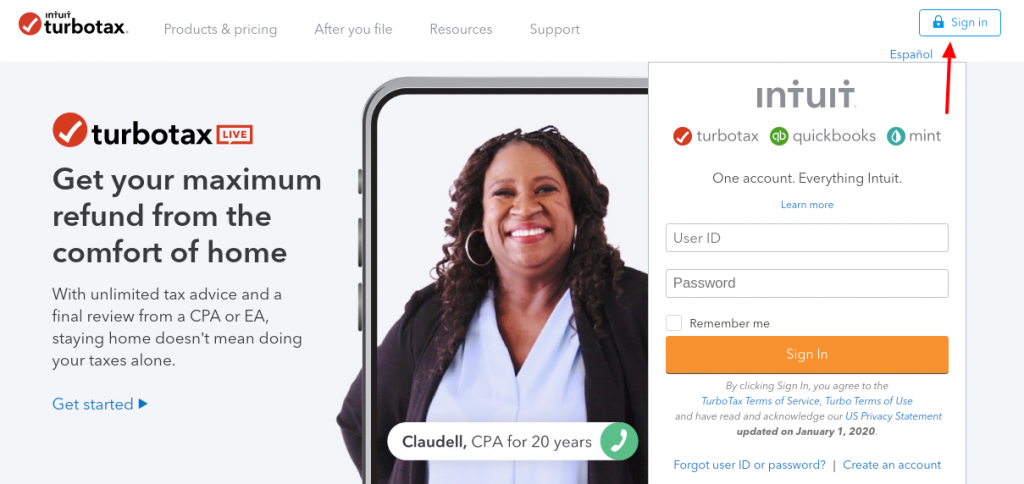

Accessing Turbo Tax Account :

Are you eager to check the status of your tax returns? Do you want to file for subsequent years? Want to manage the tax? Fear not; please check the details of your tax returns by logging into your Turbo Tax account:

- Open your browser and visit turbotax.intuit.com.

- Under the Sign-In section, please type in the User ID.

- Enter the Password.

- Click on Sign In. You may want to tap on Remember me if you are accessing from your personal device. Strictly skip the step if you are accessing from public devices.

Reset Credentials :

One common problem faced by the customers is to forget the User ID or Password. Customers may also forget the credentials partially leading to wrong entry of the credentials and subsequent locking of the account. In such a scenario, please follow the following steps to recover your User ID securely.

- Open your browser and visit https://turbotax.intuit.com/.

- Click on Forgot User ID or Password link.

- Type in your phone number/User ID/ email address.

- Click on Continue.

- The system will auto-populate the details of your account.

- Please choose from the following options how you would like to receive the password recovery code.

- Via text to the registered phone number.

- Via calls to a registered phone number.

- Via email to registered email address.

- You may also choose alternative verification which will be manual and time-consuming.

- Click on Continue.

- In case, you have forgotten your User ID, it will be displayed on the screen and no need to proceed further.

- For password recovery, a code will be sent to the chosen contact medium.

- Please type in the code in the given box.

- Ste up a new password.

- Retype the new password to confirm.

- Complete the setup.

- Return to the login page and access using newly set credentials to confirm the changes.

Contact Points :

- Open your browser and visit https://support.turbotax.intuit.com/contact/.

- Choose your Turbo Tax product.

- Write in detail regarding your query, requests, and complaints.

- Click on Continue.

Reference :