Access NJ Business Gateway Services- Brief Outline

The business gateway of New Jersey Business Gateway Services is managed by the Division of Revenue and Enterprise Services (DORES) web portal. The primary aim of the NJ Business Gateway Services is to provide services of the highest quality to the community of the business owners, state, local administration as well as taxpayers. The services that are catered by the New Jersey Business Gateway Services are:

- Commercial and business registration accessing information and filing.

- E filing and payment and filing services for the government.

- Non-taxable debt collection.

- Storing and electronic imaging of the government documents.

- Consolidating and automating the common of government transactions.

- Payment processing and tax returns.

- Recording of revenue.

- Record Management State wise.

Here, prospective and established business owners will learn the basic process to start online recording and registering for the business both for tax and employer purposes.

Choosing the Name/Alternative Name of Business

To begin with, start by choosing the name for the business. For that, business owners may want to look up for the availability of business names. This will ensure business name will not be the same as any other business name within New Jersey or outside, both domestically and internationally.

- Check for the availability of business name from the link www.nj.gov/treasury/revenue/checkbusiness absolutely at free of cost.

- To get assistance in checking the name of the business availability, you may give a call at the Division at 609.292.9292. Charges are applicable for assistance. Reservation of name facility is available in this case.

- If the business is formed outside New Jersey, then the business name must be as exactly as it is mentioned in the formation document in the home state.

- If the name is already being used by another commercial entity of New Jersey, the non-New Jersey business is required to pick up secondary or doing business as a name for the purpose in New Jersey.

- Foreign businesses must make use of the ‘dba’ name.

- For ‘dba’ designated business online registration process is not available. In that case, applicants are required to download the form from the link www.nj.gov/treasury/revenue/pdf/2000 on page number 23 and 24. While adopting dba name to the foiling, the applicant must also attach the business’ resolution.

- Alternate/Fictitious Names too can be utilized to conduct business in the state.

- Sole proprietorship trade names must be filed at the County Clerk’s office.

Step 1: How to Record New Business Groups and Entities

- Businesses belonging within New Jersey, outside New Jersey, domestically and internationally with legal entity status of the limited partnership, Limited Liability Company, or corporation must file authorization or formation documents for the public record.

- Corporations will be subjected to corporation business tax from the date of formation via the legal date dissolution.

- Legal entities must go through annual report filings.

- All profit businesses, local and foreign as well as foreign non-profit businesses must make a payment of a statutory filing fee of $125.

- The domestic non-profit organization must make the payment of $75.00 as a statutory filing fee.

Online Application

- Open your browser and visit www.njportal.com/DOR/BusinessFormation/Home/Welcome.

- Tap on the Get Started tab.

- Select your Business Types from the dropdown list.

- Type in the Business Name.

- Tap on Continue to enter information like business data, purpose, and address.

Also Read : Manage Your Cash net USA Loan Account

Step 2: Registration for Employer and Tax Purposes

This process must be completed by all the businesses, profit, non-profit, foreign, or domestic. Please go through the points:

- In this step, business owners must file the Form NJ-REG to get registered for the Employer and Tax Purposes.

- On filling up, it will ensure that business entities will be registered under an accurate Tax Identification Number.

- Apart from that, the applicant will henceforth, receive timely notices, and proper returns.

- It will also provide the registered with the Federal Employer Identification Number (FEIN) as Tax Identification Number of New Jersey which is a must-have for businesses with employees.

- One who has not yet obtained FEIN can apply directly from IRS online site via www.irs.gov/businesses.

- As per the previous step, if you are subjected to the entity authorization/formation, then you are required to submit both the tax registration and business entity. You can also file for NJ-REG later.

- Applicants who have filed NJ-REG after authorizing/forming, then it must be done within 60 days of new business entity pursuant as per Step 1.

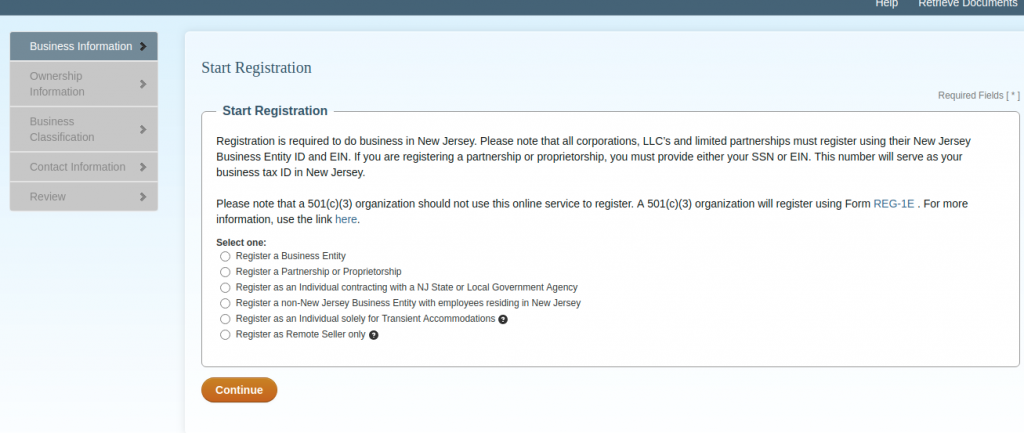

Online Registration

- Open your browser and visit www.njportal.com/DOR/BusinessRegistration/Home/FirstStep.

- Please select your type of registration from the given option.

- Tap on Continue.

- You have to proceed according to the option you have chosen.

Contact Info

On facing difficulties regarding the application, you can contact directly to the New Jersey e-Government Services Help Desk.

Phone

Dial 609-586-2600.

Write mail at support@njportal.com.

For questions regarding the Formation application fill up, you need to connect with the NJ Division of Revenue & Enterprise Services Corporate Filing Unit.

Phone

Dial 609-292-9292.

Visit www.state.nj.us/treasury/revenue/revgencode.

From the service category, please select the New Business Formation and proceed to fill up the contact form.

Reference