Avail The Card-Servicing Of Post Office Money Card

Post Office Money is a newcomer in the market of the UK and gives a scope of credit cards for their clients. The cards are appropriate for each need, and you will get a balance transfer, abroad spending, and bigger buy alternatives from these cards. Being a piece of MasterCard these are material in 35 million places internationally. The Visas are given by the Bank of Ireland UK.

Simple online access is an unquestionable requirement for something as important as a Mastercard account. Fortunately, Post Office Money Credit Card conveys this to its clients through the easy to understand Post Office Card-Servicing page. Upon landing in the page the enrollment procedure can be started by first tapping the Register Now connect before entering a card number, name, expiry date, date of birth, and mother’s original last name to confirm the record subtleties. When the entirety of the necessary check data has been entered the Verify Account catch can be clicked to continue with the enlistment procedure. After the record has been effectively enlisted it very well may be entered by composing in a username and secret phrase before tapping the Login button. The individuals who have overlooked a secret word can tap the Reset Now interface posted at the Post Office Card-Servicing page to start the online record recuperation process.

Advantages of Post-Office card-adjusting

Permits undertakings, for example, checking an equalization or looking into exchanges to be done on the web

The date an installment is expected can be checked

The way toward mentioning a parity move should be possible advantageously on the web

Installments can be made and direct record charges can be orchestrated

The measure of an accessible credit extension can be seen

The individuals who wish to take comfort to an unheard-of level can have a go at downloading the Post Office Money Credit Card portable application by clicking one of the symbols posted at the Post Office Card-Servicing page (accessible on Google Play and at the App Store). Numerous inquiries concerning the card can be tended to by checking on the data found under the Help and Support tab posted at the highest point of the page.

Features of Post Office Money Card

You can use it worldwide as MasterCard is accepted in over 35 million places.

No fee for Travel Money, it is when you pay with your card in a Post Office branch or online.

Avail contactless payments.

Get to buy Post Office Travel Money with no fee.

Also, pay no annual fee for the card.

Check if you’re eligible before you apply and it won’t affect your credit score.

Manage your account anywhere, 24/7 with our safe, secure mobile app or through online servicing.

Rates and fees of Post Office Money Card

The foreign usage charge is 2.99%

Get 0% on purchases and 0% on balance transfers for 8 months with 2.89% transfer fee

The APR variable is 19.9%

The purchase variable is 19.9%

Balance transfer fee 2.89%

The late payment fee is, £12

The credit limit is, £1200

The minimum credit limit is, £500

Register for Post Office Money Card

To register you need to visit the site, www.postoffice.co.uk/card-servicing

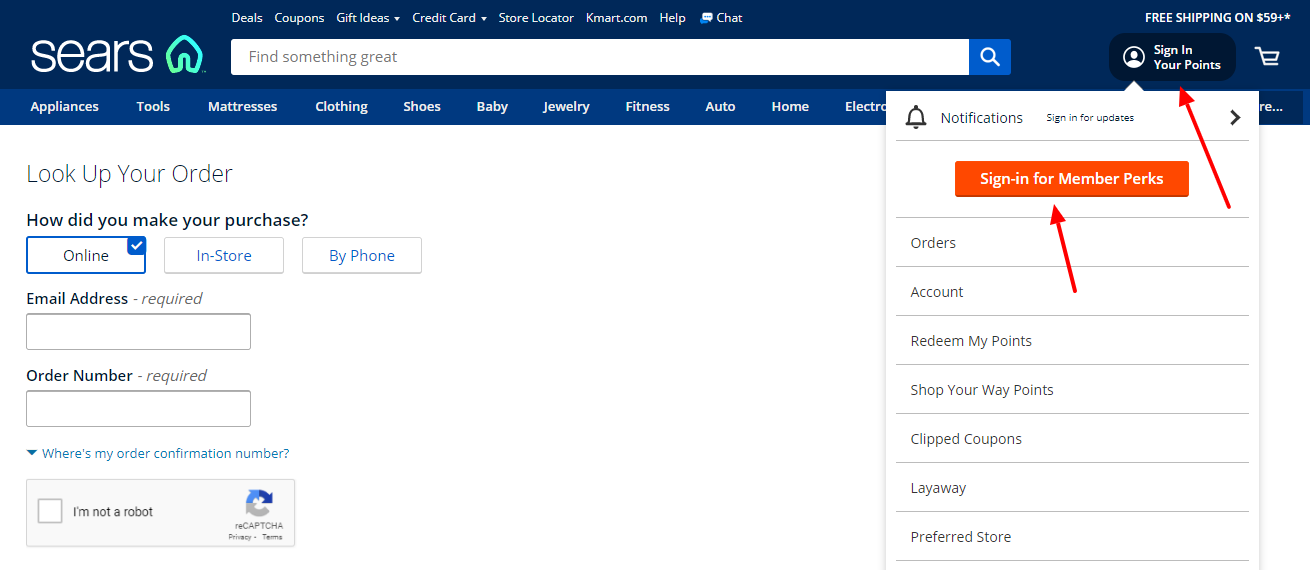

Here at the top right of the page, you will get three options and you need to click on the first one, ‘Account login’ in red.

You will get a drop–down and you have to choose the seventh option, ‘Credit card’ and click on it.

In the next page choose your card from the middle, and click on, ‘Login’ in red.

You will be directed to a new tab.

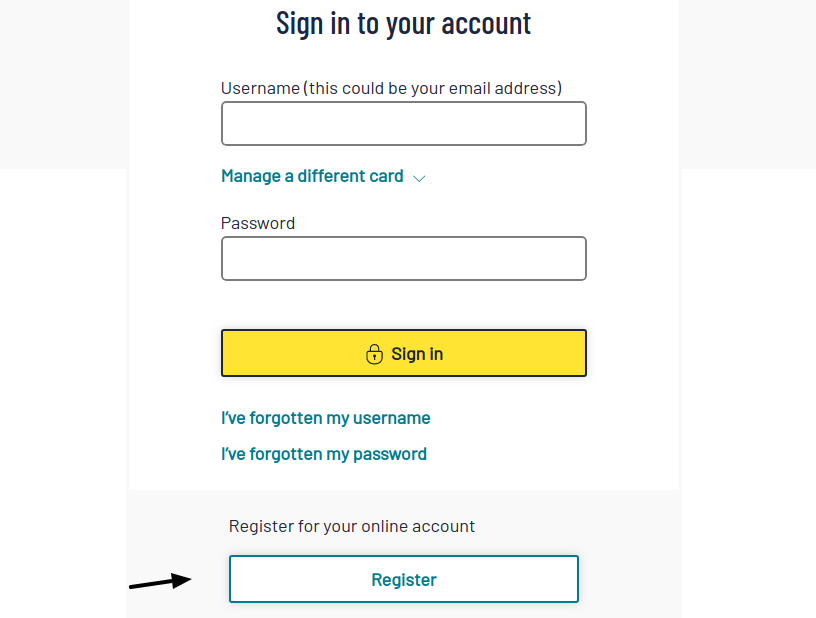

On the next page at the middle right side click on, ‘Register now’.

On this next place, at the middle left side you will get the blanks and here you have to type,

The card Number

The name as it appears on your card

The card Expiry Date

Date of Birth

Mother’s Maiden Name

After entering the details, at the bottom of the page at the left side click on, ‘Verify account’ in red.

Logging in to Post Office Money Card

For login, you need to go to,www.postoffice.co.uk/card-servicing

Here at the top right of the page, you will get three options and you need to click on the first one, ‘Account login’ in red.

You will get a drop–down and you have to choose the seventh option, ‘Credit card’ and click on it.

In the next page choose your card from the middle, and click on, ‘Login’ in red.

You will be directed to a new tab.

On this page, the left side you will get the login blanks, and you have to type

The username, and

The confirmed password.

Then, at the left side click on, ‘Login’ in red.

Contact details

For more help on the servicing, you can call on these numbers,

Customer Service – 0345 607 6500

Applications – 0800 169 2000

Reference :