Login to Kohl’s Credit Card Account :

The Kohl’s Credit Card is a fundamental store Visa just useful for shopping at Kohl’s. Like most store cards, you needn’t bother with ideal credit to get it, however, the cost for generally simple access is a high APR, so you’ll need to utilize this card for limits as opposed to conveying a balance.

Luckily, the limits are abundant, particularly in case you’re a continuous customer who goes through a great deal with Kohls. Cardholders get 35% off their first buy just as extra markdown coupons consistently.

Features of Kohl’s Credit Card:

- All Kohl’s Card clients get additional investment funds offers consistently, including an uncommon commemoration offer each year.

- Advance warning of Kohl’s Card deals occasions via mail.

- Admittance to My Kohl’s Card, which gives admittance to your record balance, free online installments, and capacity to pursue paperless e-articulations.

- Admittance to versatile installment alternatives like Kohl’s Pay and portable bill installment.

- At the point when Kohl’s Card clients burn through $600 each year, they become Most Valued Customers.

Rates of Kohl’s Credit Card:

- The regular APR is 24.99%

- Max Late Fee is $38

- Grace Period is for 25 days

- There is no smart chip

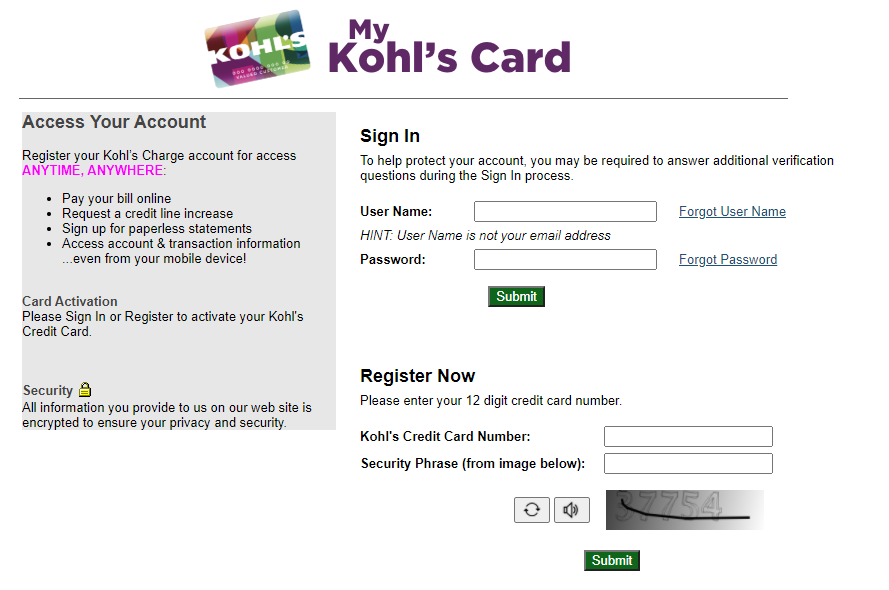

Kohl’s Credit Card Login:

- To login open the webpage kohls.com/activate

- As the page opens at the center you have to enter the login details such as.

- Username, password now click on the ‘Submit button.

How to Retrieve Kohl’s Credit Card Login Details:

- To recover the login details open the page com/activate

- After the page appears on the login homepage hit on the ‘Forgot username’ button.

- In the next screen provide the credit card number, security phrase hit on the ‘Next button.

- For password recovery enter username, SSN click on the ‘Next button.

Register for Kohl’s Credit Card Account:

- To register for the account open the webpage com/activate

- As the page appears in the login homepage enter the information such as

- Credit card number, security code hit on ‘Submit’ button.

Also Read : How To Apply BP Credit Card

Kohl’s Credit Card Perks:

- It’s A Credit Card, Not A Charge Card: Don’t let the confusing name fool you: Even though it’s called the Kohl’s Charge, the product is a traditional credit card, not a charge card. The Kohl’s Charge is, however, a closed-loop store card, meaning you can use it only at Kohl’s.

- You’ll Get Savings and Coupons, Though It’s a Lot of Track: Many store credit cards, such as the Target RED card Credit Card, offer cardholders a discount on every purchase. The Kohl’s card is different. Instead of knocking off 5% or so at checkout, Kohl’s runs regular promotions and sales to give cardholders extra opportunities to shop at a discount.

- Bigger Spenders Can Earn Status: When you spend $600 with your Kohl’s card in a calendar year, you’ll earn Most Valued Customer status. That MVC status entitles you to additional savings and offers throughout the year, including a special birthday gift. You’ll also enjoy exclusive free shipping periodically.

- You Won’t Want to Carry a Balance: Like many store credit cards, the Kohl’s card comes with a hefty ongoing annual percentage rate, meaning interest charges could cost you dearly if you don’t pay the card off in full each month. The APR will fluctuate, but it could be as high as 24.99% or more.

- You Can See If You Pre-Qualify Without a Hard Pull On Your Credit: If you’re interested in a Kohl’s card but worried that you may not qualify, you can check before applying without penalty. Visit the Kohl’s Charge section on the website and look for the pre-qualification link.

- Introductory Discounts: For starters, when you open a new Kohl’s card, you may qualify for one-time savings off your first purchase on your new card. A common offer is to save an extra 35% off your first purchase, plus an extra 15% coupon when your new card arrives in the mail.

Kohl’s Charge Card Contact Details:

To get further details call on the toll-free number +1 (800) 564-5740.

Reference Link: